Premier Li Keqiang makes an inspection visit to the People’s Bank of China on June 20. [Photo/Xinhua]

Premier Li Keqiang made inspection visits to the head office of China Construction Bank (CCB) and the People’s Bank of China on June 20 and hosted a symposium for the financial sector.

When visiting the CCB head office, the Premier acknowledged its businesses concerning supporting real economies, implementing replacement of business tax with a value-added tax and serving mass entrepreneurship and innovation. Finance is the lifeblood of the national economy and the tax burden of the finance industry should be ensured to be eased in the pilot tax reform, said Premier Li, adding that commercial banks should improve their abilities to serve the real economy, especially for micro- and small-sized enterprises.

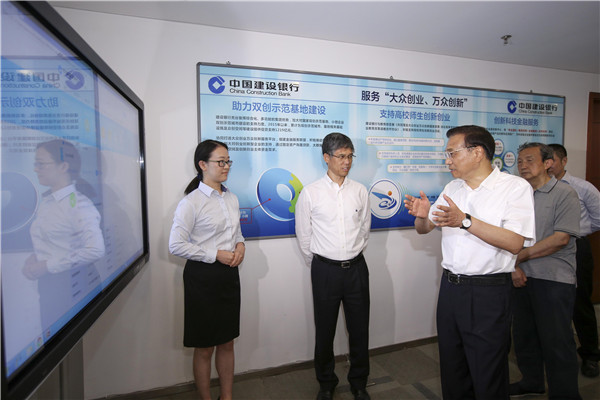

Premier Li Keqiang makes an inspection visit to the head office of China Construction Bank on June 20. [Photo/Xinhua]

At the monetary policy department of the People’s Bank of China, the Premier stressed they should closely track both domestic and international economic and financial situations, make comprehensive use of various policy tools, keep a reasonable and adequate liquidity, and correctly guide market expectations to cope with all kinds of risks and challenges, promote the sustainable and stable economic development and build a good financial environment.

At the symposium for the financial sector, Premier Li had in-depth discussions with the heads of financial institutions on the current major issues, and the head of the People’s Bank of China made a report. Premier Li hailed the hard work made by the staff members of the financial system on promoting economic development and maintaining financial stability.

Premier Li Keqiang presides over a symposium for financial sector at the People’s Bank of China on June 20. [Photo/Xinhua]

The Premier said that China, challenged by the fluctuations and uncertainties of the international financial market in the past year, has continued to promote financial reforms, in which banking industry has grew steadily, potential risks of the capital market has been dissolved, and the RMB exchange rate remains basically stable at a reasonable and balanced level. However, the Premier added, we must be aware of the sluggish global economic growth and the difficulties in the development of some areas and industries in China.

We should continue to insist on prudent monetary policy, step up coordinating it with proactive fiscal policy, enhance its flexibility and make it more specific, pay more attention to presetting and fine tuning, strive to keep a reasonable growth of total credit, implement differentiated financial policy, support structural reform, especially the supply-side structural reform, and increase support for key areas and weak links, so as to surmount difficulties and achieve upgrades of China’s economy, said the Premier.

Premier Li stressed that increasing supports to agriculture, farmers and rural areas is crucial to make the finance sector better serve the real economy. At present, the priority is to provide good financial services for the purchases and storage of summer grain crops, and support the deep processing of agricultural products, with efforts to ensure the benefits of farmers and consumers, the Premier added.

Premier Li also called for more investment to resolve the financing difficulties of enterprises, especially micro- and small-sized enterprises and private enterprises, and regulate deposit or assessment fees in the process of enterprises’ financing.

The Premier required commercial banks to introduce more effective and preferential measures to help both micro- and small-sized enterprises and private economy get capital to meet their financing need. The measures will boost private investments and avoid financing difficulties for small enterprises with good credibility and market share.

We should actively support new economy, cultivate new driving force and encourage the spirit of mass entrepreneurship and innovation in financial institutes, and develop financial products that are beneficial to the development of real economy, said the Premier. Meanwhile, the service methods for the development of internet Plus, modern logistics, green energy, and high-tech manufacture should be innovated, and financing support for the upgrade and transformation of the service sector, emerging industries and traditional industries should be further strengthened.

Premier Li stressed deepening reforms is the key to improve the efficiency of financial resource allocation and effectively avoid the financial risks.

We should further push forward the move of administrative streamlining, delegating power and improving services for the financial sector. And we need to establish more small and medium financial institutes, such as private banks and consumer finance companies, to deliver abundant financial services, said the Premier.

In addition, we must promote equity financing in multiple ways, establish multi-layer capital market transfer mechanism, develop regional equity market that serves micro- and small-sized enterprises, promote the health development of the bond market and improve the ratio of direct financing. The leverage ratio for non-financial market should be lowered through top-down design, marketing and legalization, the Premier added.

Furthermore, the establishment of necessary financial market mechanism and regulation and management of financial institutes should be enhanced and strengthened. We should improve the supervision in financial system based on new situations and new requirements. Related departments should do their duties to enhance the risk monitoring, recognition and alarm, pay attention to cross-market, cross-sector and cross-institute crimes, especially abnormal cross-border capital flow, and better fulfill the work for internet financial risk control, said the Premier.

Vice-Premier Ma Kai, State Councilor Yang Jing and Governor of the People’s Bank of China Zhou Xiaochuan also took part in the inspection visits and the symposium.