Premier Li Keqiang has expressed his concern several times over the VAT reform, an important part of fiscal-taxation system overhaul.

He has said many times that taxation should be reduced in all industries. Following are the occasions where Premier Li has spoken about the VAT reform.

May 23, 2016

Shiyan, Hubei province

During his inspection tour to Hubei province, Premier Li visited a local bank on May 23. He enquired about the taxation change on financial organizations after the implementation of the VAT reform. The Premier stressed that the financial industry should avoid tax increase on real economy.

At the local citizens’ service center, Premier Li heard that the tax base was expanding though tax revenue was decreasing. “We promote the reform to reduce tax for enterprises, thus to stimulate more vitality of market entities, “ the Premier said.

April 25, 2016

Chengdu, Sichuan province

Premier Li visited tourist spot Kuanzhai Alley in Chengdu on April 25. He asked several shop owners about their business condition and tax burden. He also listened to their opinions on the VAT reform.

April 11, 2016

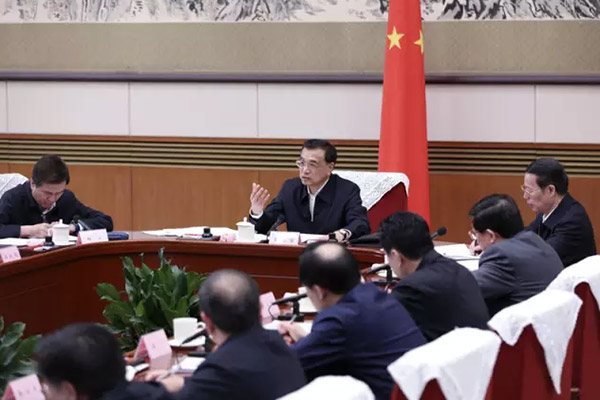

The State Council symposium

Premier Li presided over a symposium on April 11 to research related problems on implementing the VAT reform. Ideas from some provinces were proposed and work for the next step was deployed.

“VAT reform is an important move of deepening reform. It may involve the interests of many sides. But we are determined to promote it. Ministries should work closely together to solve the problems we may encounter,” the Premier said.

April 1, 2016

State Administration of Taxation, Ministry of Finance

One month before the overall promotion of the VAT reform, Premier Li inspected the State Administration of Taxation and the Ministry of Finance and chaired a symposium on April 1.

“Taxation should be reduced in all industries. This should not be read without understanding. The implementation of the reform depends on your careful operation.” Premier Li stressed.

March 18, 2016

The State Council executive meeting

At the State Council executive meeting presided over by Premier Li, it was decided to approve the promotion of VAT pilot areas in an all round way. It was decided that pilot programs will be expanded to construction, real estate, finance and life service industries starting from May 1, 2016. Tax deduction will be used to support the development of modern service industry and the upgrading of manufacturing industry.

March 5, 2016

The Government Work Report

Premier Li made it clear in the 2016 Government Work Report that VAT reform will be promoted in an all round way in 2016. Pilot areas will be expanded from May 1. The VAT of newly added properties of all enterprises can be contained into tax deduction.

Jan 22, 2016

Symposium to promote VAT reform and accelerate fiscal-taxation system reform in an all round way

At the symposium chaired by Premier Li on Jan 22, it was decided to promote VAT reform and accelerate fiscal-taxation system reform in an all round way to relieve the tax burden for enterprises and stimulate the enthusiasm of all sides.

Premier Li said the move should be planned carefully. The reform will cause a large scale of tax reduction, which needs the central and local governments to fully implement the policy. The reform should be promoted gradually and steadily to avoid influence on the stable operation of economy.