Residents purchase vegetables in a supermarket in Cangzhou, north China’s Hebei province, Nov 8, 2014. China’s consumer price index, a main gauge of inflation, grew 1.6 percent year on year in October, the National Bureau of Statistics (NBS) said on Nov 10.[Photo/Xinhua]

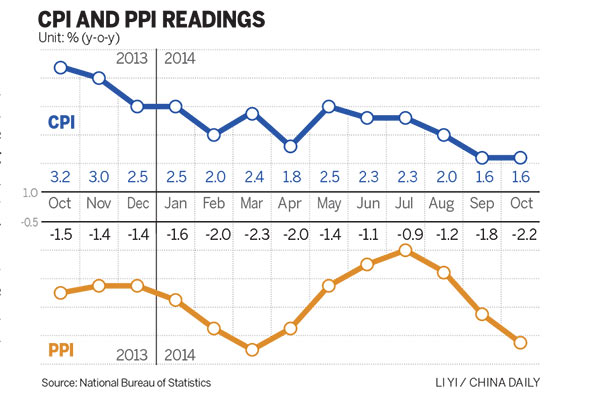

China’s consumer inflation hovered around 1.6 percent in October, the lowest pace since January 2010, suggesting weak growth momentum and expectations that policymakers may roll out more measures to prop up growth.

The Consumer Price Index, a main gauge of inflation, remained more or less flat at the level seen in September, but still down from the 2 percent in August, the National Bureau of Statistics said on Monday.

Food prices increased by 2.5 percent year-on-year in October, compared with 2.3 percent growth in September, contributing the most to the headline inflation. Non-food prices rose 1.2 percent in October, compared to 1.3 percent in September.

Weak domestic demand and declining oil prices have led to the low inflation, said Yu Qiumei, a senior economist at the NBS. During the first 10 months of the year, annual inflation grew by 2.1 percent year-on-year, much lower than the government’s 3.5 percent full-year target.

A research note from Nomura Securities said that the subdued inflation in October reflects a soft start to the fourth quarter. The Japanese brokerage had expected policymakers to cut the bank reserve requirement ratio by 50 basis points at the start of the fourth quarter, to support the economic growth rebound to 7.6 percent from 7.3 percent during the third quarter.

In October, the Producer Price Index fell by 2.2 percent from a year ago, compared to a drop of 1.8 percent in September and further widened the deflation risks, the NBS said. The PPI has fallen consecutively for 32 months since March 2012.

“Falling commodity prices and worsening overcapacity in upstream industries due to the ongoing property market correction could be major factors for the PPI deflation,” the Nomura research note said.

JP Morgan China Chief Economist Zhu Haibin said that the returning deflation pressure on industrial prices is consistent with the decline in the manufacturing PMI input price components, as global commodity prices remained weak in recent months.

He said the central bank may continue to adopt the current approach of monetary easing in unconventional ways, such as providing stable liquidity to guide lower market interest rates, using targeted RRR cuts and monetary instrument innovations to support certain sectors, and controlling overall credit growth but using regulatory measures to change credit components, with the objectives to improve credit support to the real economy.

Residents purchase vegetables in a supermarket in Cangzhou, north China’s Hebei province, Nov 8, 2014. China’s consumer price index, a main gauge of inflation, grew 1.6 percent year on year in October, the National Bureau of Statistics (NBS) said on Nov 10.[Photo/Xinhua]