China will not inject a large amount of newly added financial investment to stimulate the economy this year, a senior official at the country’s top economic planner said on Jan 8.

The current scenario is “fundamentally different” to the one in 2008, when a 4 trillion yuan ($651 billion) stimulus package was launched by the government, the official said.

The National Development and Reform Commission said in December that China will increase investment for “seven project packages”, including oil and gas networks, health and pension services, ecology and environment, clean energy, and transportation.

Luo Guosan, deputy director general of the commission’s Investment Department, said the seven sectors have clearly indicated China’s future investment direction.

But it is difficult to give a figure for this year’s investment, either for projects involving the seven sectors or infrastructure, Luo said.

“Construction of some projects has started, while some have only just started preliminary work,” Luo added.

On Jan 6, Bloomberg reported that China is accelerating 300 infrastructure projects valued at 7 trillion yuan this year as policymakers seek to increase growth that is in danger of slipping below 7 percent.

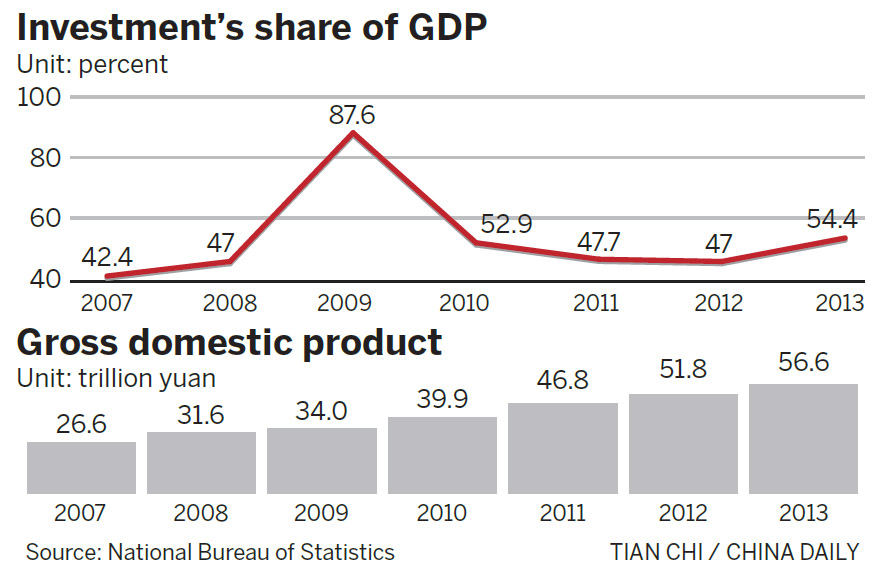

Many have linked the new round of investment to the 4 trillion yuan stimulus package introduced in 2008. This led to investment’s contribution to GDP rocketing to 87.6 percent in 2009, up from 47 percent in 2008, to counter a disastrous fall in exports.

“It is quite different from the stimulus package in 2008,” Luo said.

“The critical point is that we won’t use a large amount of newly added fiscal input to stimulate the economy, but instead guide social capital’s participation in investment-that’s a very important policy direction,” Luo said.

Wu Yaping, an investment expert at the Academy of Macroeconomic Research, the commission’s think tank, said China had loosened its monetary policy and provided ample liquidity to boost growth in 2008 and 2009 when the financial crisis hit.

But the country’s monetary policy has since shifted to a more prudent approach.

Wu said China is expected to implement this prudent monetary policy more flexibly in 2015 by raising interest rates or cutting the targeted required reserve ratio and adopting more proactive fiscal policies to boost the economy.

“Maintaining an economic growth rate above 7 percent remains very critical for China,” Wu said.