Outbound merger and acquisition activities were the main investment option for Chinese companies in overseas markets last year, according to the Ministry of Commerce.

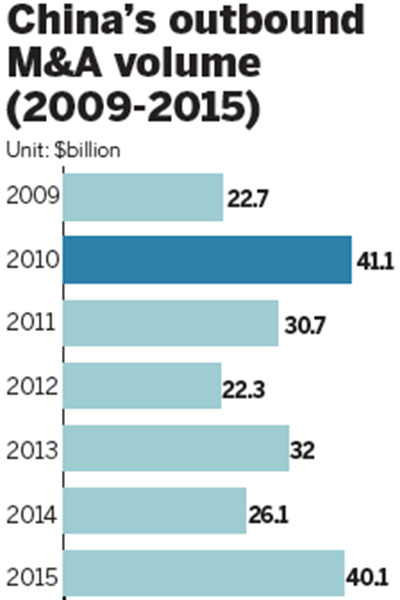

Companies from China conducted 593 M&A deals worth $40.1 billion in 2015. This included the purchase of a nearly 60 percent stake in Italian tire producer Pirelli & C SpA by China National Tire and Rubber Co Ltd, the biggest outbound acquisition by a Chinese firm in 2015.

Shen Danyang, spokesman for the ministry, said the surge in outbound M&A deals can be attributed to a host of developments that have taken place both outside and inside China.

Within the country, a relaxed policy environment, abundant cash reserves and a rising private sector have spurred Chinese companies to learn from their foreign rivals and seek bargains overseas via M&A.

Source: China Chamber of International Commerce and Ministry of Commerce[Liu Lunan/China Daily]

With China’s business influence rising, a growing number of foreign companies in developed countries are now keen to partner or work with Chinese companies.

Shen said the focus of China’s outbound M&A activities has shifted from State-owned enterprises seeking natural resources to deals with an eye on growing market share and core capabilities.

There have been fewer deals in energy and resources, and more in industrial and consumer goods, finance, technology and telecommunications last year, data from the ministry show.

“Outbound M&A deals are a practical way for Chinese companies to pursue new profit drivers, gain new market access, cutting-edge technologies and even prestigious global companies,” said Zhao Zhongxiu, a professor who researches overseas investment at the University of International Business and Economics in Beijing.