A modest rebound of industrial output in April was not enough to lift the downward pressure on the economy caused by the persistent weakness in property development and corporate investment.

The latest monthly economic figures reflect the risk that GDP growth may again slip below the government’s annual target of 7 percent in the second quarter, say experts.

However, more large public infrastructure projects are underway, and this may result in higher growth in the coming months.

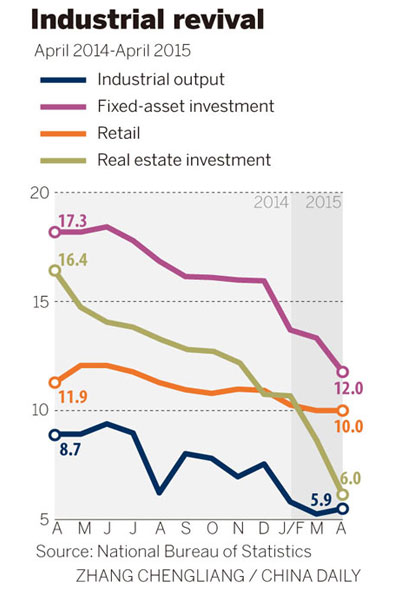

Industrial output rose by 5.9 percent year-on-year in April, up from 5.6 percent in March, the National Bureau of Statistics reported on Wednesday.

Over the first four months, the country achieved a growth of 6.2 percent in industrial output compared with the same period last year, the smallest year-on-year increase since 2009.

Manufacturing investment growth fell to the single-digit level for the first time in a decade, while investment in fixed assets showed only a 12 percent increase from January through April, down from 13.5 percent in the first quarter and the lowest reading in 15 years.

Housing sales improved slightly last month, but real estate construction investment, which usually accounts for 40 percent of the country’s total fixed-asset investment, rose by just 6 percent year-on-year during the first four months, the lowest figure since May 2009.

Bureau spokesman Sheng Laiyun said the figures should be viewed in the context of the country’s economic transition.

“China’s economy is still moving within a reasonable range,” he said in a commentary on the bureau’s website. “There are positive factors to ensure its growth.”

Three days before the data came out, the central bank lowered the one-year benchmark deposit and lending interest rates by 25 basis points.

Other policies, including cutting the minimum down payment for a second home, reducing tax on house sales and increasing loans from policy banks to support key infrastructure construction projects, have been adopted to stabilize growth.

“Although the NBS figures do not reflect the impact of the latest easing measures, the deceleration in economic activity suggests that policy easing probably remains behind the curve,” said Julia Wang, a China-based economist at HSBC.

The People’s Bank of China, the central bank, posted data for new credit in April. Aggregated financing, including bank loans and off-balance credit, was 1.05 trillion yuan ($169 billion), less than economists had forecast.

Louis Kuijs, the Royal Bank of Scotland’s chief economist in China, said he expects policymakers to further ease macro policy in the coming months to ensure that growth remains at around 7 percent.

“On the fiscal front, ensuring sufficient financing for infrastructure in changing circumstances has led to new initiatives,” he said.

“Overall economic growth should start to benefit in the coming months from the macroeconomic easing steps taken in recent months and from some improvement in global demand.”